The Great Rewiring

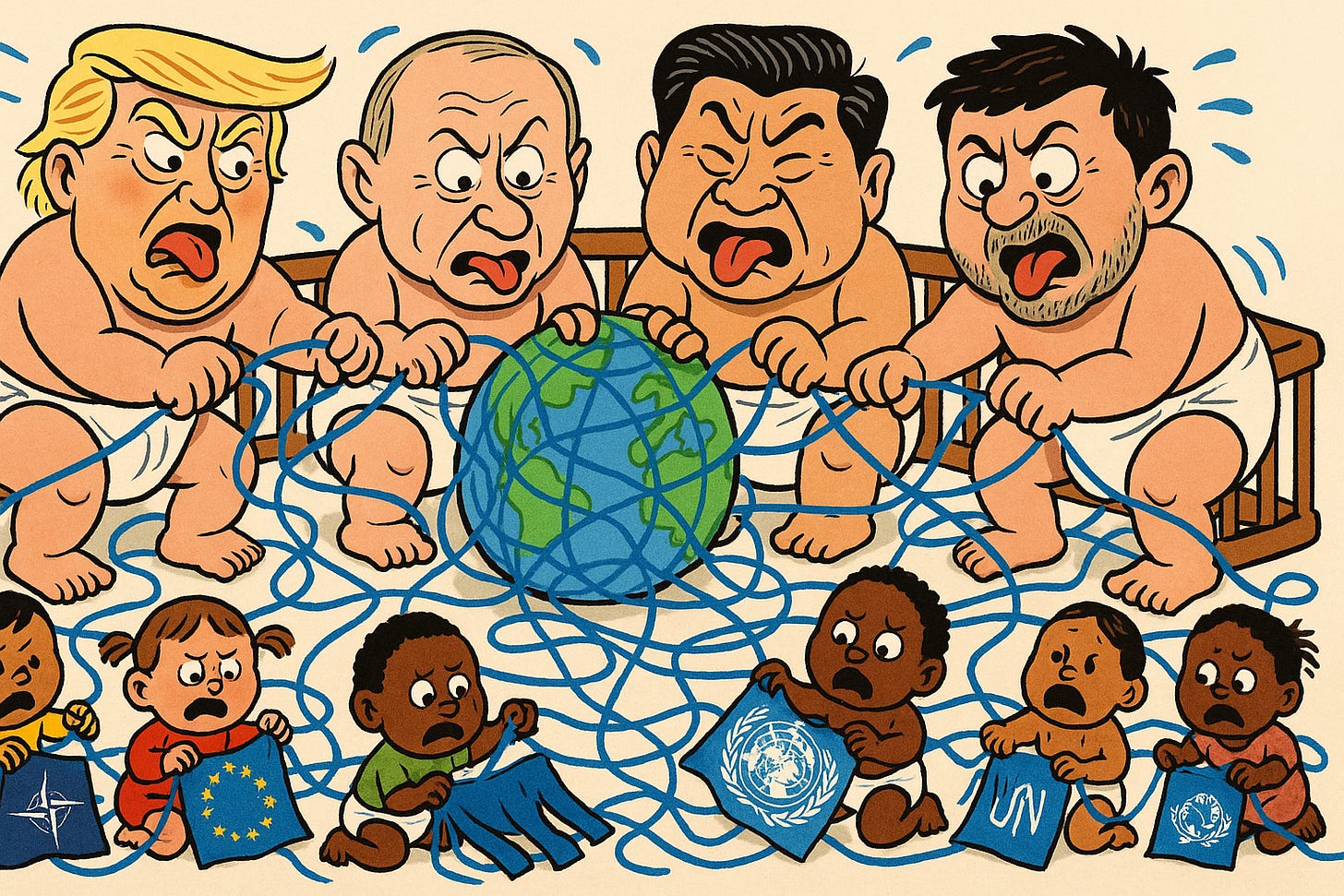

How Ukraine's war is unraveling the old world order and hastily stitching together a new one.

By Robert Muggah and Mark Medish

The world is sliding into an age of managed disorder, and Ukraine is where the new geometry comes into view. What began as Russia’s bid to subdue a neighbor is now a stress test of the international system from its deterrents to its supply chains. The longer the war grinds on, the clearer a pattern emerges: geopolitical p…